In the final months of last year, it was clear to many of us in the property investment sector that something “big” was about to happen in property markets around the nation.

We started to see a sharp uptick in enquiry from potential clients as buyer demand started to ramp up.

At the same time, the property listings started to dry up, which caused a significant imbalance between supply and demand.

Of course, when this happens it creates upward price pressure on real estate, which was already under way in some markets before this year had started.

By the time that the school year had begun, the price of property had started to rise strongly month on month – a situation that continued throughout this year.

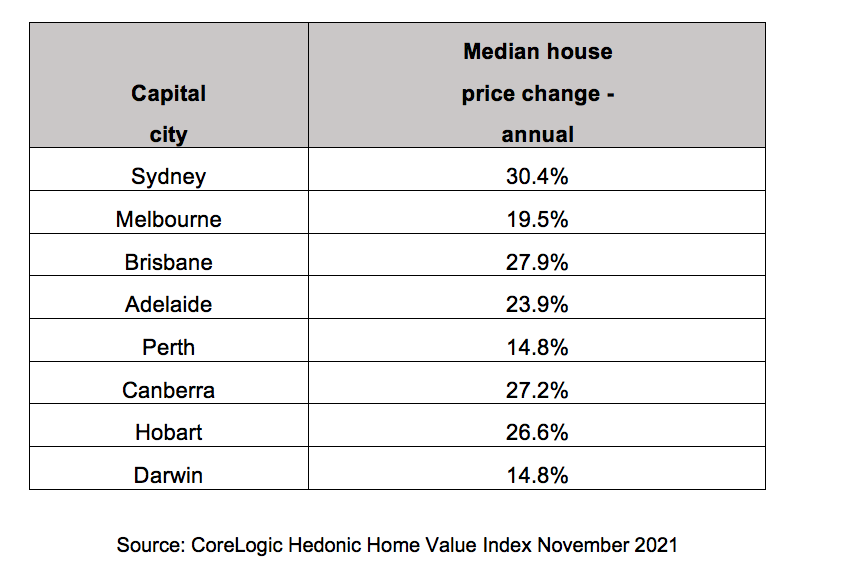

Since the start of the year, median house prices have grown by double digits in every capital city as well as most major regional areas.

However, some of the price growth in some locations is difficult to comprehend, especially in markets where the fundamentals don’t seem to add up.

What’s next for markets?

There is growing evidence that some major property markets have started to moderate.

Some of the statistics that are starting to flow through to support this point of view include an increase in the number of new property listings for sale in Sydney and Melbourne in particular.

With additional supply coming on to the market, as well as buyer demand impacted by affordability issues in these two areas, then it stands to reason that the recent robust price growth will likely not continue into next year.

Indeed, if we think back to the peak of the Sydney market in about 2017, when the median house price had soared to about $1 million, it is tricky to reconcile the fact that it is now an extraordinary $1.35 million.

Likewise, in Melbourne, where it was $750,000 but is now approaching $1 million.

Ditto, another extreme example of the rampant price growth over the past year is Hobart, which did have a number of years of strong growth before the pandemic.

However, its median house price of about $400,000 four years ago, has now morphed into $726,000 – a figure that is the same as Brisbane, and higher than Adelaide or Perth.

For a city with about one-tenth of the population of Brisbane, it is difficult to understand the market’s performance this year – even though there has been a marked shift to lifestyle locations.

Only time will tell what happens to prices in these cities over coming months.

But, next year, we will continue to buy into Brisbane – as we have been doing for a few years already – because we believe there is still plenty more price growth to come there.

We are expecting house prices to continue to rise in Brisbane next year, possibly by up to about 10 per cent or even more in some select locations.

This is partly because its median house price remains significantly below Sydney and Melbourne, plus it has a massive major infrastructure program well under way and is welcoming record numbers of interstate migrants as well.

We will also be scoping out another capital city that we believe provides plenty of upside potential – we just can’t talk about that publicly yet!